Bank Announces Changes to Loan-to-Value Ratio Requirements for Investment Properties

26 June 2024

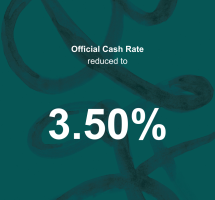

In a recent update, one of the main banks in New Zealand has made a significant adjustment to its loan-to-value ratio (LVR) requirements for residential investment lending. Effective from June 24, 2024, the bank has increased the maximum LVR from 65% to 70%. This change aligns with the latest amendments to LVR restrictions announced by the Reserve Bank of New Zealand (RBNZ).

The modification aims to provide investors with increased borrowing power, potentially enhancing their ability to invest in residential properties. The bank's decision reflects a response to the evolving financial landscape and RBNZ's regulatory adjustments, aiming to stimulate the property market by making it more accessible for investors.

For a deeper understanding on how the recent changes have implications for your current and future investment portfolios, please feel free to reach out to our experienced advisers at O'Hagan Home Loans and Insurances for a comprehensive review of your financial situation.