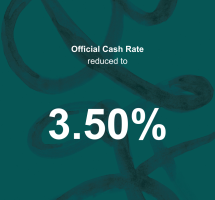

OCR has dropped to 3.50 %

New Zealand's OCR has dropped to 3.50 %! Official Cash Rate (OCR) drops typically lead to lower interest rates, which can have positive implications for various financial

Holiday Hours 2024 - 2025

We’re taking a short break to recharge over the Christmas and New Year holidays. Our offices will be closed from 12PM, December 20, 2024 to January 12, 2025. We are back on

O'Hagan Home Loans and Insurances Merge with Apex Advice to Enhance Services

O’Hagan Home Loans & Insurances, a trusted name in Whakatane for over 30 years, is excited to announce a strategic merger with Apex Advice. This collaboration will empower O’Hagans

OCR announcement - what does this mean for you?

Earlier today the Reserve Bank announced they have cut the OCR by 0.25%, lowering it to 5.25% - the first cut in 4.5 years. With inflation now sitting within the target band of 1 – 3% the

Bank Announces Changes to Loan-to-Value Ratio Requirements for Investment Properties

In a recent update, one of the main banks in New Zealand has made a significant adjustment to its loan-to-value ratio (LVR) requirements for residential investment lending. Effective from June 24,

Prioritising Insurance Cover Amidst the Rising Cost of Living

As the cost of living continues to rise, many of us are feeling the financial strain. With everyday expenses such as food, rent or mortgage payments, and more climbing higher, it’s no surprise

Navigating the End of the First Home Grant: Strategies for Increasing First Home Buyer Deposits

The recent announcement by Housing Minister, Chris Bishop, regarding the scrapping of the First Home Grant has significant implications for prospective first home buyers in New Zealand. This

Goal Setting in 2024

As we say goodbye to 2023 and look forward to 2024 the start of a new year allows us to stop and contemplate what we hope to achieve in the upcoming year. This includes financial goals. The

How Proposed LVR Changes Could Help You Secure Your Dream Property

Are you thinking about buying your first home or investment property? Well, you could be in a stronger position to purchase because the Reverse Bank of New Zealand (RBNZ) has proposed easing

Time to say good buy? Fewer investors could be the key for first home buyers!

As experienced mortgage advisers, the team at O’Hagans understands that the New Zealand housing market can seem unpredictable! However, we’ve got good news for all the first home buyers

Can I Buy a house with a low deposit?

While the current finance markets can make it more difficult to purchase a home with a low deposit (ie less than 20% of the purchase price) there are still many options out there. In order to

First Home Buyer - how to get into the market?

Many people today are commenting that they will never own their own home. This is far from the truth. There are many ways to enter the property market and for people to buy their

Why should I get insurance?

Insurance is a form of “risk transference” e.g you are not in a financial position to address the risk yourself so you transfer that risk to a 3rd party such as an insurance agency.

Top Tip Tuesday - Is using buy now pay later a good move?

If thinking about applying for a home loan, try to avoid any buy now pay later products such as Laybuy, Afterpay, Zip, Humm or Pay day loan type products. While these may appear to be a good idea to

Top Tip Tuesday - Expenses

Align your expenses with your pay schedule. For example, if you get paid weekly then make as many of your payments on your commitments weekly so that those are paid first and you don't have to

Home Loan Affordability

Over the past few months we have seen a lot of media coverage regarding the difficulties of obtaining lending to buy a home. Credit criteria to be met is tougher following the introduction of the

Top Tip Tuesday - Kiwisaver

For first time buyers Kiwisaver is the main vehicle you’ll use for a deposit. If you feel that you’re not a good saver we would recommend increasing your Kiwisaver contribution above the

CCCFA - What does this mean for me?

Great news! In the recent weeks the Government have reviewed the interpretation of the CCCFA which was introduced 01/12/2021. Initially this casued banks to go on a major credit crunch resulting in

Approaches to Arranging Personal Insurance

When they are considering personal insurance we generally find from our previous experience that clients come to us with one of three different proposals. The first is based on what we, as